The Hidden Gem of the Hill Country: A Guide to Seguin Texas Real Estate

Why Seguin Texas Real Estate is the Hill Country’s Best Kept Secret If you have been watching the housing market

Buy, Sell & Live in the Texas Hill Country

Welcome to my blog, your premier resource for buying, selling or owning Texas Hill Country real estate.

The entire Texas Hill Country is in growth mode, with Comal County in particular projected to double in size by 2060.

Whether you are looking to buy a home, sell your property, or explore financing options, I provide the expert analysis you need. My local insights help you navigate the market with confidence.

Browse the latest articles below to stay updated on market trends and opportunities in the local real estate market.

Why Seguin Texas Real Estate is the Hill Country’s Best Kept Secret If you have been watching the housing market

This guide explores the best San Antonio neighborhoods that serve as gateways to the Hill Country, offering a blend of

Living in San Marcos Texas offers a unique blend of river adventures, university culture, and hill country charm. Discover the

When it Comes to Texas New Construction, You Can Always Refinance the Rate, But You Can Never Refinance the Price

The “Shiny Object” Trap: Is Texas New Construction Costing You Thousands More Than Resale? Quick Answer: While builders in Central

Discover Garden Ridge, TX—the hidden gem of the Texas Hill Country. Explore custom homes on large lots, top-rated Comal ISD

From navigating “WORD” permits to understanding water levels, here is everything you need to know before buying a home and

Once known just for pie and cheap starter homes, Kyle has transformed into a job hub with massive developments like

They share a school district and a border, but these two San Antonio suburbs couldn’t be more different. Here is

Flipping Houses in the Austin San Antonio Corridor: A Real-World Guide for Investors Introduction: What House-Flipping TV Gets Wrong If

Unlocking Your Earned Benefit: The Complete Guide to VA Loans Welcome to the Complete Guide to VA Loans, where we

Quick Summary: Texas FHA Loans at a Glance Best For: First-time buyers, buyers with credit scores of 580+, and those

Are you a real estate investor struggling to qualify for traditional mortgages despite having profitable rental properties? DSCR loans (Debt

If you’re carrying high-interest credit card debt, personal loans, or other monthly payments, refinancing your mortgage to consolidate debt can

The Hidden Cost of Waiting to Buy: How Much Delaying Really Costs You Understanding the hidden cost of waiting to

How To Choose a Home In a Buyer’s Market (Texas Buyer’s Market Guide) Texas is experiencing a true buyer’s market

Should I Buy a Home Now or Wait? Understanding Today’s Rates. If you’re wondering whether to buy a home now

Can I buy a home while I still own my current home? Quick Answer: Learning how to buy a house

Should I Refinance for a Lower Rate? A Simple Rule of Thumb That Actually Works Is Refinancing Your Mortgage Worth

Stop Playing by Outdated Rules and Start Dominating Local Real Estate SEO When it comes to real estate SEO, you’ve

I’ll be honest with you: I’m a tech person who loves AI and sees its potential everywhere. But I was

Fly fishing in the Guadalupe River, the southernmost river for trout in the United States 5 Things I Didn’t Realize

If you are thinking of buying a home in 2026, here are the credit mistakes to avoid. Dreaming of buying

If you have been dreaming of buying a home, you might be held back by common Texas mortgage myths. Many

5 Truths About Texas Investment Property Loans Every Investor Should Know If you have already purchased a primary residence, you

Save Thousands with Texas Property Tax Exemptions in Comal County, Hays County, and Beyond If you own property—or are thinking

Get Preapproved What is PITI? The Four Letters That Define Your Financial Future The sticker price of a home is

Volume Builders Are Behind the Boom in Underwater FHA Loans We’re starting to see something interesting in the data across

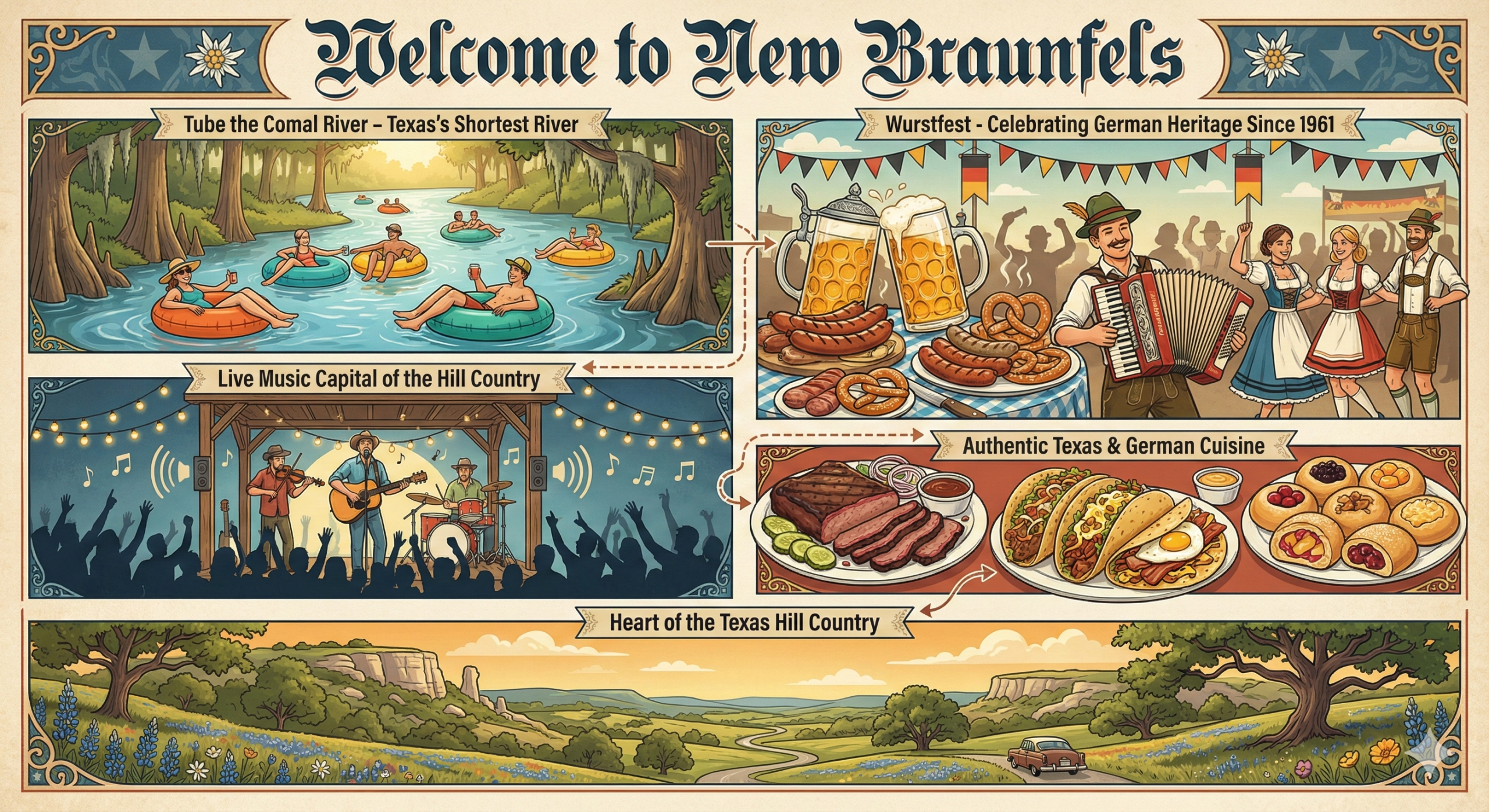

Welcome to the heart of the Texas Hill Country — where crystal-clear rivers, live music, and a slower pace of

The allure of the Texas Hill Country has transformed from a regional secret into a national phenomenon. As we move further into 2026, the landscape of Texas Hill Country real estate continues to evolve, offering a unique blend of rural charm and sophisticated living. For homebuyers, investors, and families looking to relocate, understanding the nuances of this diverse market is critical. It isn’t just about finding a home; it is about securing a lifestyle that balances the tranquility of the rolling hills with the economic vitality of the Austin-San Antonio corridor.

While the limestone bluffs, cypress-lined rivers, and bluebonnet fields are the initial draw, the staying power of the Hill Country market lies in its infrastructure and community. Towns like New Braunfels, Boerne, Fredericksburg, and Dripping Springs have developed robust local economies. They are no longer just “weekend getaways” but fully fledged communities with top-rated schools, medical centers, and high-speed internet that supports the remote-work revolution.

In 2026, we are seeing a shift in buyer priorities. The demand for acreage remains high, but there is a growing interest in “luxury low-maintenance” living—communities that offer the Hill Country aesthetic without the heavy lifting of ranch management. This diversity in housing stock helps stabilize the market, providing options for first-time buyers, retirees, and luxury estate seekers alike.

One aspect often overlooked in Texas Hill Country real estate blogs is the complexity of financing rural and semi-rural properties. Unlike standard suburban subdivisions, Hill Country properties often come with unique characteristics that require specialized lending knowledge.

USDA and Rural Loans: Many areas just outside the major city limits still qualify for USDA financing, offering 0% down payment options for eligible borrowers. This is a massive advantage for buyers looking to maximize their purchasing power in towns that feel rural but are close to urban amenities.

Land and Construction Loans: With inventory tight in some historic town centers, many buyers are opting to purchase land and build custom homes. Understanding the “one-time close” construction loan process is vital for these projects, allowing borrowers to finance the lot and the build in a single transaction.

Jumbo and Non-QM Options: As property values in the region have appreciated, more homes now fall into Jumbo loan categories. Navigating these higher loan limits requires a mortgage strategy that looks at the borrower’s full financial picture, not just a credit score.

Real estate in this region has historically been a strong hedge against inflation. The “corridor” between San Antonio and Austin is one of the fastest-growing regions in the United States. Owning property here is not just a lifestyle decision; it is a strategic financial move. Short-term rentals continue to be a driver in tourist-heavy towns like Fredericksburg and Wimberley, though prospective owners must be vigilant about changing local zoning ordinances.

For the long-term investor, the focus in 2026 is on the “path of progress”—areas where infrastructure improvements, such as road expansions and utility upgrades, are planned but not yet completed. Buying in these emerging pockets of the Hill Country can offer significant appreciation potential over a 5-to-10-year horizon.

Ultimately, the Texas Hill Country real estate market is hyper-local. A market trend in Comal County might look completely different than one in Gillespie County. Relying on national data or generic real estate advice often leads to missed opportunities.

At Home Qualify, our goal is to bridge the gap between finding a property and securing the right financing to keep it affordable. Whether you are looking for a riverfront escape, a family home in a master-planned community, or a ranchette with room to breathe, having expert guidance ensures you make decisions based on facts, not just forecasts. We are committed to providing the data, tools, and insights you need to navigate the 2026 market with confidence.

Find out what you can afford in 30 seconds