The Hidden Cost of Waiting to Buy: How Much Delaying Really Costs You

Understanding the hidden cost of waiting to buy a home is one of the most important steps buyers can take before deciding whether to move noIf you’ve been thinking about buying a home but keep telling yourself, “Maybe I should wait for rates to drop…” — you’re not alone. It’s the #1 hesitation buyers have right now. here’s the truth most people never see:

The Hidden Cost of Waiting to Buy a Home in Texas

Home prices, competition, and your monthly payment rarely move in the same direction at the same time. And in Texas, even small shifts in prices or tax rates can change affordability fast.

Let’s break down the real math so you can make a confident decision rather than a hopeful one.

Delaying a home purchase can cost buyers thousands due to rising home prices, increasing competition, and the loss of monthly principal build-up. Even if rates drop in the future, higher home values or increased demand often erase any payment savings. The best way to decide is by comparing today’s payment to projected costs after appreciation.

Why Waiting Almost Never Saves Money

Most buyers wait because they believe:

- Rates will drop

- Payments will go down

- Homes will become more affordable

But here’s what typically happens in Texas markets:

When rates fall → competition skyrockets → home prices jump → sellers stop offering credits → and buyers pay more anyway.

Here is where the hidden cost of waiting to buy comes in: Even if you get a lower rate later, the house itself becomes more expensive, and your payment doesn’t fall the way you expected.

Let’s look at real numbers so you can see it clearly.

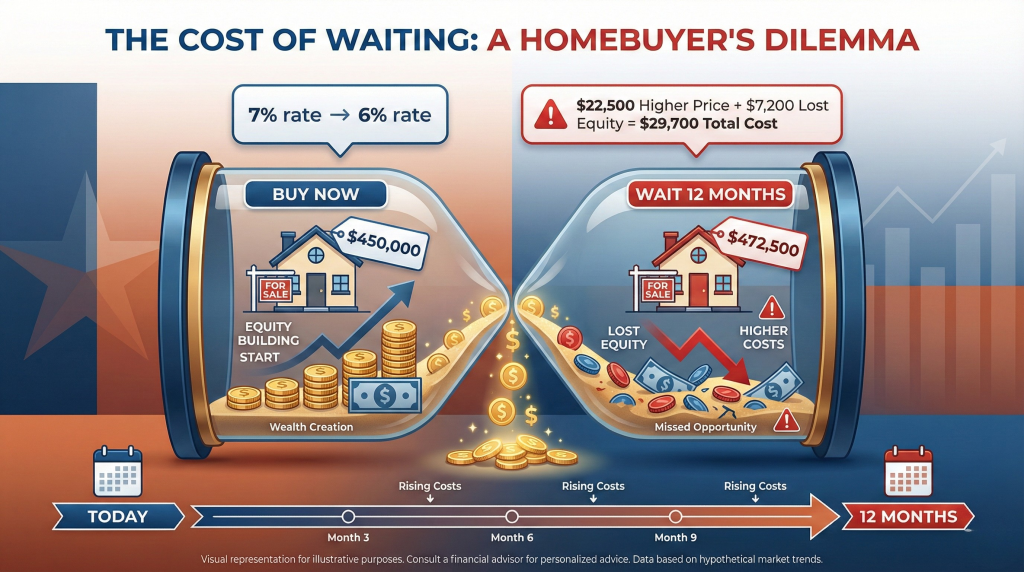

Real Math: How Much Waiting Actually Costs

Let’s compare buying now vs. waiting 12 months.

Today’s Scenario:

- Home price: $450,000

- Rate: 7.0%

- Down payment: 5%

- Monthly payment (principal & interest only): $2,994

If you wait 12 months and prices rise 5% (a conservative estimate in Texas):

- New home price: $472,500

- If rates drop to 6% (your best-case scenario):

- New payment (P&I): $2,823

Monthly savings: just $171

Cost of waiting: $22,500 higher purchase price

But that’s not the whole story…

“But My Payment Is Lower If I Wait!” — Not Really

Let’s compare total monthly cost, not just principal + interest.

In Texas, property taxes + insurance change with the value of the home.

On a $450,000 home:

- Taxes (2.25%): $843/mo

- Insurance: $170/mo

- Total monthly housing cost: ~$4,007

On a $472,500 home 12 months later:

- Taxes: ~$886/mo

- Insurance: ~$175/mo

- Total monthly housing cost: ~$3,884 with lower rate

The difference?

Only about $123/month — and that’s assuming the best case scenario on future rates.

Yet you paid $22,500 more for the house.

For an up-to-date overview of Texas property tax rules, visit the Texas Comptroller’s official website:

https://comptroller.texas.gov/taxes/property-tax/

The Silent Killer: Lost Principal Build-Up

Every month you wait, you lose the opportunity to build equity through principal reduction.

On a $450,000 purchase:

- First-year principal paid = ~$7,200

- Over 12 months of waiting, that’s $7,200 of lost equity

- Combined with price appreciation = $29,700 lost

That’s almost $30k gone by simply waiting one year.

The Big Takeaway

When you calculate the hidden cost of waiting to buy a home, it becomes clear that delaying often creates a much higher long-term expense than buying now.

Even if rates drop, waiting usually costs more because home prices and taxes rise faster than rates fall. And the lost equity compounds the longer you wait.

Why Buying Now Often Wins (Even at Higher Rates)

Here’s what buying now gets you:

1. You lock in today’s price

Even if rates drop later, the price you paid won’t go up.

2. You can refinance later

Rates change.

Your home price doesn’t.

3. You build equity immediately

Every payment builds your wealth, not your landlord’s.

4. You avoid buyer stampedes when rates fall

Today = leverage

Later = bidding wars

5. Sellers are more flexible in a buyer’s market

Right now, you can still negotiate:

- Closing cost credits

- Rate buydowns

- Repairs

- Price adjustments

You won’t get that when the pendulum swings back.

Use the HomeQualify Affordability Calculator for Your Exact Numbers

If you want to know your actual buy-now vs. wait cost, run your numbers here:

https://homequalify.ai/texas-home-affordability-calculator/

It takes 30 seconds and shows:

- Today’s payment

- Estimated future payment

- Cost of waiting

- Equity you’d build

- Break-even timelines

This tool drives conversions because buyers instantly see the math for their situation.

Summary of your Cost of Waiting to Buy a Home

Waiting to buy a home typically costs more due to rising home prices, higher property taxes, lost equity growth, and reduced negotiating leverage. Even if rates drop, the increased purchase price usually erases the monthly payment savings. Buyers should compare today’s payment to projected future costs to determine their true cost of waiting.

Ready to See Your Personal Cost of Waiting?

I’ll run a full analysis showing:

- Your exact monthly payment today

- Your projected payment if rates fall

- Home price appreciation forecasts

- Lost equity from waiting

- Whether buying now or waiting puts you ahead

Schedule a Cost-of-Waiting Analysis today and get clarity before the market shifts.