Should I Buy a Home Now or Wait? Understanding Today’s Rates.

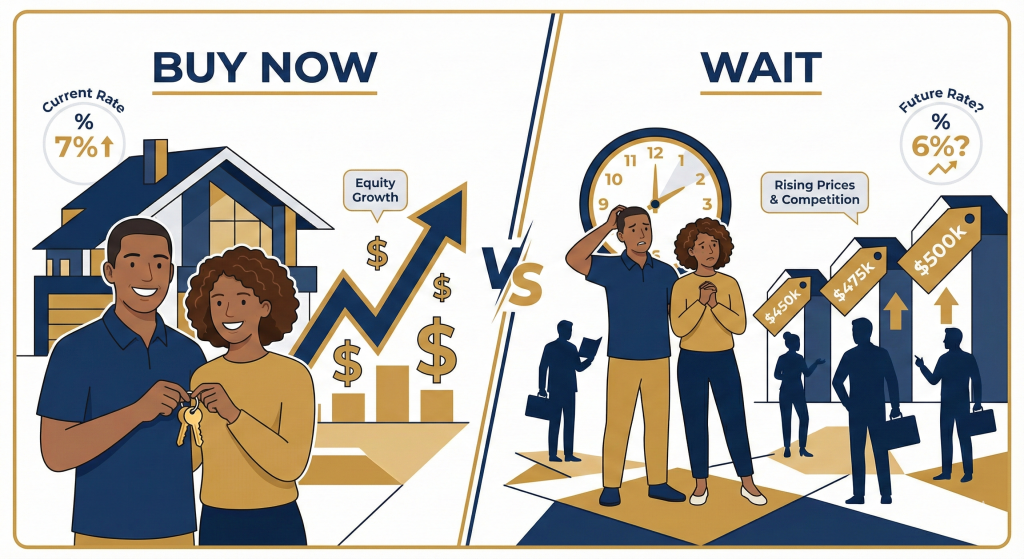

If you’re wondering whether to buy a home now or wait for mortgage rates to drop, you’re asking the right question—but you might be focused on the wrong metric. Current interest rates are higher than pandemic-era lows, but the real question isn’t about the rate itself. It’s about what waiting could actually cost you.

Quick Answer: Mortgage rates in 2025-2026 are elevated compared to 2020–2021 but remain historically normal. Buying now can make financial sense if monthly payments fit your budget and home prices are rising in your market. Waiting for lower rates often backfires when increased buyer competition drives prices higher, erasing any savings from a better rate.

Should You Buy a Home Now with Current Mortgage Rates?

How Do Current Rates Compare Historically?

Context matters when evaluating whether rates are “too high”:

Compared to 2020–2021: Today’s rates appear significantly higher than the 2.5%–3.5% rates available during the pandemic

Compared to historical averages: Current rates align with 50-year norms, not extreme highs

Compared to future projections: Rates may decline gradually, but dramatic drops are unlikely in the near term

The critical question: Does waiting for lower rates actually improve your financial position?

Why Waiting for Lower Rates Could Cost More Than Buying Now

The Hidden Cost of Falling Interest Rates

Most homebuyers assume lower rates automatically mean better deals. Here’s what actually happens when rates drop:

- Buyer demand surges as more people qualify for mortgages

- Competition intensifies with multiple offers on desirable properties

- Inventory tightens as fewer sellers list homes

- Seller concessions disappear in hot markets

- Home prices rise due to increased demand

Real scenario: A lower interest rate won’t help if the home costs $30,000–$50,000 more due to market competition.

The Real Math: Buying Now vs. Waiting for Lower Rates

Payment Comparison Example

Today’s Market (7% rate):

- Home price: $450,000

- Interest rate: 7%

- Monthly payment: ~$2,993

If You Wait (6% rate, but 5% price increase):

- Home price: $472,500

- Interest rate: 6%

- Monthly payment: ~$2,823

Result: You save only $170 per month while paying $22,500 more for the home—potentially losing money in the long run.

This demonstrates why timing the market based solely on interest rates can be costly.

Should You Buy a Home Now? 3 Reasons It Makes Sense

1. Buy Now, Refinance Later Strategy

Secure your home today at current prices, then refinance when rates drop. This proven approach lets you:

- Lock in today’s home prices before appreciation

- Build equity immediately instead of paying rent

- Refinance to lower payments when rates improve

- Avoid competing in a heated market later

2. Reduced Competition Means Better Deals

Higher rates temporarily sideline casual buyers, giving serious buyers negotiating leverage:

- Seller-paid closing costs

- Price reductions on listed properties

- Home repairs and improvements included

- Rate buydown options

- Extended timelines for inspections and decisions

These advantages often disappear when rates fall and competition returns.

3. Building Equity vs. Waiting on the Sidelines

Every mortgage payment builds equity in your asset. Renting builds nothing.

Consider: Even in a high-rate environment, homeownership creates wealth through:

- Principal paydown each month

- Property appreciation over time

- Tax advantages of homeownership

- Fixed housing costs (unlike rising rents)

When Should You Wait Instead of Buying a Home Now?

Buying isn’t always the right decision. Consider waiting if:

- Monthly payments strain your budget beyond comfortable limits

- You plan to relocate within 1–2 years (closing costs won’t be recouped)

- You’re rebuilding credit or savings to qualify for better terms

- Job or income stability is uncertain in the near future

Smart homebuying requires financial margin and stability, not stress.

Decision Framework: Should You Buy Now or Wait?

Buy a Home Now If:

✓ Monthly payments fit comfortably in your budget ✓ You’ve found a property meeting your needs ✓ You want to avoid bidding wars when demand increases ✓ You prefer locking in prices before market appreciation ✓ You’re comfortable refinancing later for better rates

Wait to Buy If:

✓ Current payments exceed your comfort level ✓ Your near-term plans are uncertain ✓ You need time to improve credit scores or savings ✓ Your local market shows declining prices

Both decisions can be financially sound when made intentionally with full information.

FAQ: Common Questions About Buying in a High-Rate Market

Q: Will mortgage rates drop significantly in 2026? A: While rates may decline gradually, dramatic drops are unlikely. Economic factors suggest modest decreases rather than returns to pandemic-era lows.

Q: How much can I save by refinancing later? A: Refinancing when rates drop 1% on a $450,000 mortgage could save $200–$300 monthly, making the “buy now, refinance later” strategy attractive.

Q: Are home prices expected to rise or fall? A: Most markets show continued appreciation, though rates vary by location. Local market analysis is essential.

Q: What credit score do I need for the best rates? A: Typically 740+ scores qualify for optimal rates, though good options exist for scores as low as 620.

Take the Next Step: Personalized Rate Analysis

The right decision depends on your specific financial situation, local market conditions, and long-term goals. Instead of guessing, get data-driven clarity with a personalized analysis including:

- Current payment calculations based on your budget

- Projected payments if rates decrease

- Local appreciation estimates for your market

- True cost comparison: buying now vs. waiting

- Side-by-side scenarios for your exact situation

Bottom line: Today’s mortgage rates may feel high, but buying now can be financially smarter than waiting if payments fit your budget and prices are rising in your area. Many successful buyers purchase now and refinance later to optimize their investment.

Don’t let interest rate anxiety prevent you from building equity and securing your ideal home. The best time to buy is when the numbers work for your situation—regardless of where rates stand.

Ready to analyze your specific buying scenario? Contact us for a no-obligation consultation and personalized buy-now-vs-wait comparison using your actual numbers and local market data.