Quick Summary: Texas FHA Loans at a Glance

Best For: First-time buyers, buyers with credit scores of 580+, and those with low savings.

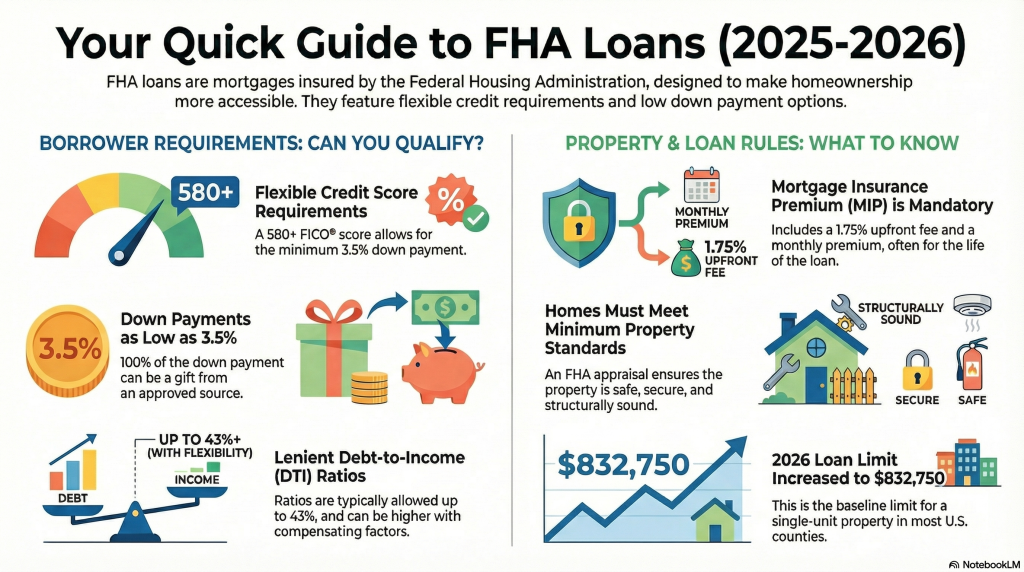

Minimum Down Payment: 3.5% (Credit Score 580+) or 10% (Credit Score 500-579).

2026 Loan Limits: $524,225 in most Texas counties; up to $571,550 in high-cost areas like Austin.

Key Benefit: More lenient on debt-to-income ratios and credit history than conventional loans.

Introduction: Your Path to Texas Homeownership

Navigating the specific Texas FHA loan requirements for 2026 can feel challenging, but achieving homeownership is often more accessible than you think. Whether you’re eyeing a new build in New Braunfels or a historic home in Houston, understanding these rules is your first step.

For many aspiring buyers, an FHA loan provides the most affordable and flexible path to purchasing a home. The standout feature is the low down payment requirement, allowing you to buy a home with as little as 3.5% down. This makes it an excellent solution for first-time homebuyers looking to put down roots in our thriving economy.

As an FHA loan specialist with Edge Home Finance based right here in the Texas Hill Country, I’m Steve Tomaselli. This guide will walk you through everything you need to know to qualify in the Lone Star State.

What Is an FHA Loan?

It’s crucial to understand: the Federal Housing Administration (FHA) is not a lender—it is an insurer.

The Lender: Private companies (like Edge Home Finance) issue the funds.

The Insurer: The FHA (part of HUD) insures the loan.

This government insurance protects the lender if a borrower defaults. Because this risk is reduced, lenders can offer lower rates and more flexible approval standards to buyers who might not qualify for a strict Conventional loan.

Key Benefits of an FHA Home Loan

Why is the FHA loan the “go-to” for thousands of Texans?

Low Down Payment: You can qualify with just 3.5% down. On a $350,000 Texas home, that’s a down payment of just $12,250.

Flexible Credit Requirements:

580+ Score: Qualifies for the 3.5% down payment.

500-579 Score: May still qualify with a 10% down payment.

> Pro Tip: If your score is just below 580, don’t give up. I can run a “credit simulator” to show you exactly which debts to pay down to boost your score by those few critical points.

Higher Debt-to-Income (DTI) Ratios: While Conventional loans often cap you at 45% DTI, FHA automated underwriting can sometimes approve DTIs as high as 56.9% if you have compensating factors (like cash reserves or a stable job history).

Gift Funds Allowed: 100% of your down payment can be a gift from a family member. We just need a signed gift letter and a paper trail.

Versatile Property Types: Use an FHA loan for single-family homes, condos, or even 2-4 unit multi-family properties (as long as you live in one unit). This is a popular “house hacking” strategy in Austin and San Antonio.

Texas FHA Loan Requirements (2026)

To qualify, both you and the property must meet specific HUD criteria:

Borrower Requirements

Credit Score: Minimum 580 for maximum financing.

Residency: Must be your Primary Residence. You cannot use FHA for investment properties or vacation homes.

Employment: 2 years of steady employment history (same line of work is preferred).

Property Standards (The FHA Appraisal)

An FHA appraisal checks value and safety. In Texas, appraisers look for:

Safety/Soundness: No exposed wiring, broken windows, or severe roof damage (roof must have 2+ years of life left).

Foundation: Critical in Texas clay soil areas. Major cracks may require an inspection.

Systems: HVAC and water heaters must be functional.

Mortgage Insurance (MIP)

FHA loans require two types of insurance premiums to fund the program:

Upfront MIP (1.75%): Usually rolled into your loan amount (you don’t pay this out of pocket).

Annual MIP: Paid monthly. For most borrowers, this is 0.55% of the loan balance annually.

Note: Unlike PMI on conventional loans, FHA MIP generally stays for the life of the loan unless you put 10% down (in which case it falls off after 11 years).

2026 FHA Loan Limits in Texas

One of the most critical Texas FHA loan requirements is the loan limit, which updates annually to keep pace with home prices. These limits vary by county:

| County Area | 1-Unit Limit (2026) |

| Standard Texas Floor (Most Counties) | $524,225 |

| Dallas / Fort Worth (Dallas, Collin, Tarrant) | $563,500 |

| Austin / Round Rock (Travis, Williamson, Hays) | $571,550 |

| San Antonio / New Braunfels (Bexar, Comal) | $557,750 |

Contact me to see the specific limit for your target county.

FHA vs. Conventional: Which is Right for You?

| Feature | FHA Loan | Conventional Loan |

| Credit Score | 580+ (flexible) | 620+ (strict) |

| Down Payment | 3.5% | 3% – 5% |

| Mortgage Insurance | Life of loan (usually) | Cancellable at 20% equity |

| Interest Rates | Often lower for <700 scores | Higher for <700 scores |

Verdict: If your credit score is under 720 or your down payment savings are tight, FHA is often the mathematically superior choice. If you have 740+ credit and 5-20% down, Conventional might save you money on insurance.

Frequently Asked Questions (FAQ)

Can I buy a home in Texas with bad credit?

Yes. The Texas FHA loan requirements are generous and allow credit scores as low as 500. However, scores between 500-579 require a 10% down payment. Scores of 580+ qualify for the 3.5% down payment.

What is the maximum FHA loan amount in Texas for 2026?

For most counties, the limit is $524,225. In higher-cost areas like Austin, it rises to $571,550.

How long does an FHA appraisal take?

In Texas, FHA appraisals typically take 5-7 business days, though this varies by rural vs. urban locations.

Conclusion: Start Your Journey

An FHA loan is a powerful vehicle for making homeownership a reality in Texas. Whether you are in New Braunfels, Dallas, or anywhere in between, the flexibility of this program is unmatched.

Steve Tomaselli (NMLS 358920) and the team at Edge Home Finance specialize in helping buyers navigate these specific Texas FHA loan requirements. We don’t just quote rates; we build a total cost analysis for you.

Ready to see what you qualify for?

Visit homequalify.ai/purchase to run your numbers instantly, or contact me directly to start your pre-approval.

Disclaimer: Loan programs, limits, and requirements are subject to change without notice. This is not a commitment to lend. Edge Home Finance is an Equal Housing Lender.